Northern Ireland Faces Critical Workforce Shortage of 5,400 Workers Annually in the Coming Decade

Northern Ireland is heading towards a significant workforce crisis, with projections indicating a shortage of approximately 5,400 workers per year across various sectors, according to a recent skills analysis.

The Northern Ireland Skills Barometer 2023-2033, developed by the Ulster University Economic Policy Centre, reveals trends concerning the region's future labour market. Despite forecasts showing workforce growth to around one million jobs by 2033—representing an increase of 79,000 jobs over the decade—demographic patterns and labour market structures suggest a substantial skills gap across all qualification levels.

Growth Sectors and Challenges

The projected job growth spans multiple sectors, including agri-tech, life and health sciences, advanced manufacturing, materials and engineering, fintech and financial services, software and cyber, screen industries, and initiatives supporting low-carbon and net-zero goals.

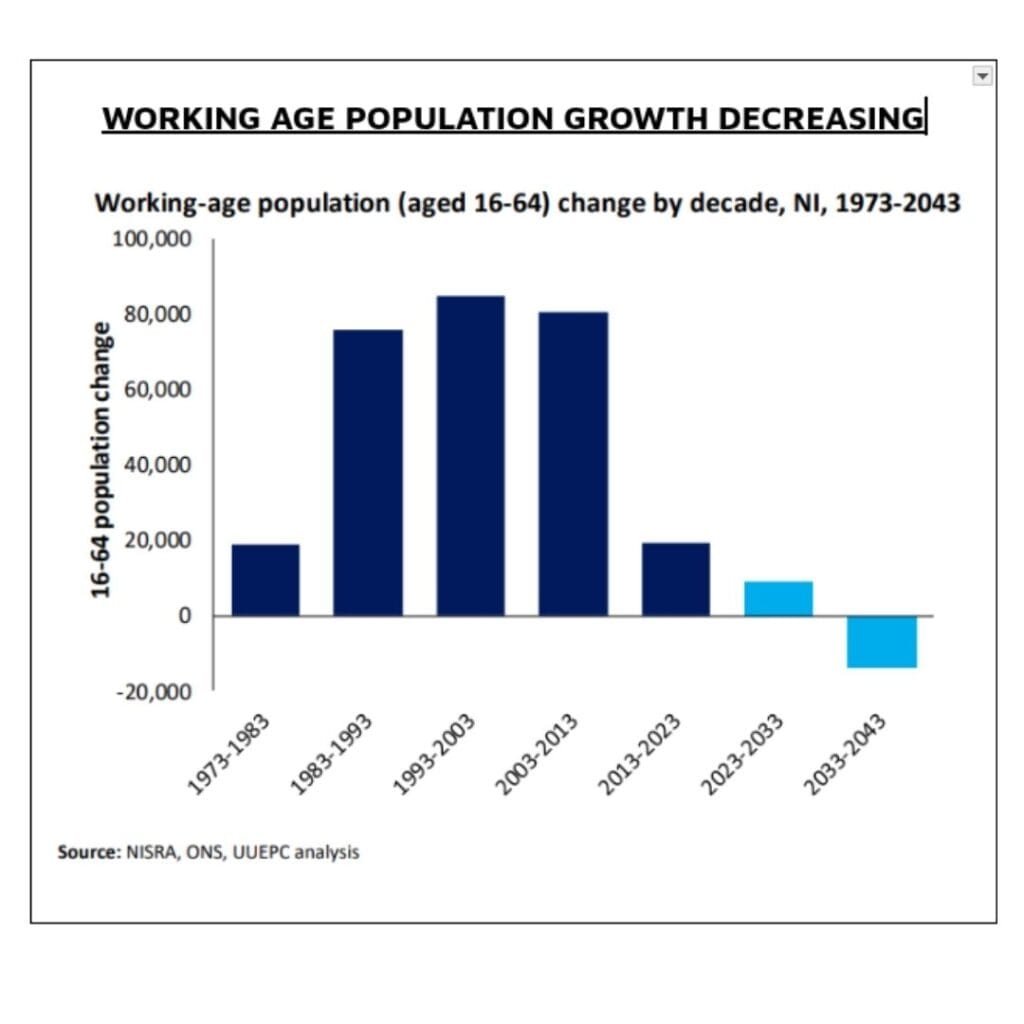

However, the barometer highlights a troubling mismatch between labour demand and supply. The region's ageing population presents a particular challenge, as the number of young people in the workforce is not sufficient to meet the increasing job demands, as you can see in the image below.

UK-Wide Labour Market Challenges

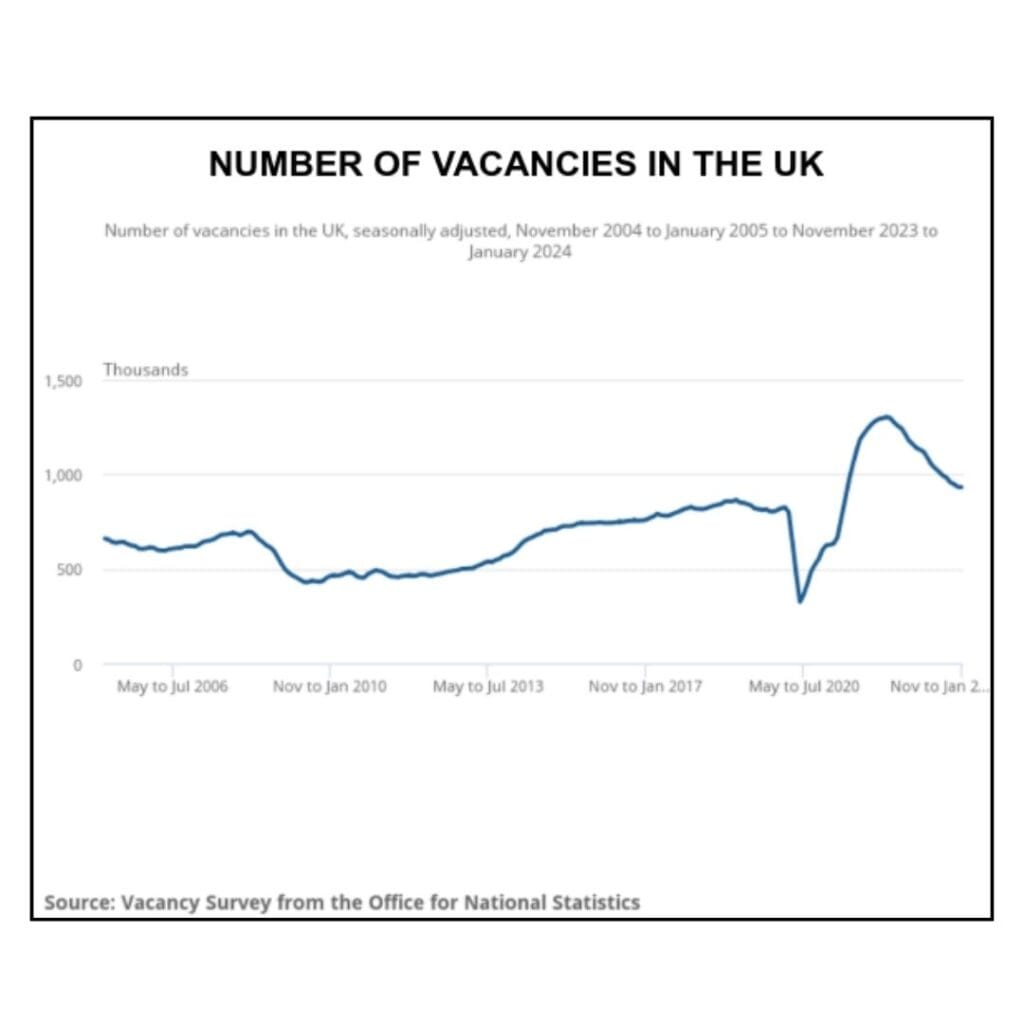

Northern Ireland's workforce challenges are similar to UK trends. According to the Office for National Statistics, the UK vacancy rate remains high despite recent decreases, with approximately 932,000 job vacancies across the UK in early 2023.

The Recruitment and Employment Confederation (REC) reports that 91% of UK businesses have experienced difficulties filling positions in the past 12 months, with 42% citing skills shortages as the primary obstacle to recruitment.

Another research from the Chartered Institute of Personnel and Development (CIPD) indicates that 45% of employers have positions that are hard to fill, with shortages in healthcare, engineering, IT, and construction sectors.

Brexit Complications

Economy Minister Caoimhe Archibald noted that Brexit has further complicated the situation by limiting Northern Ireland's ability to recruit workers from EU countries, intensifying the need to develop local talent and remove barriers to employment.

"The traditional answer is upskilling people who are out of work, and that remains important. But it is also vital to support people once they are in employment," Archibald stated.

Strategic Responses

The Department for the Economy is exploring ways to better support employers in attracting and retaining workers. Despite anticipated financial constraints in the coming year, Archibald confirmed that the Skills Barometer will guide prioritisation efforts to ensure maximum impact from available resources.

Mark Magill, senior economist at Ulster University and author of the report, described the Skills Barometer as providing "a vital evidence base for policymakers, educators, and employers to shape Northern Ireland's Skills Strategy and drive long-term sustainable economic growth."

Investment in Skills

The research underscores the critical importance of continued investment in skills development, particularly in STEM, digital skills, transversal skills, and lifelong learning opportunities.

"Investing in these areas will be essential to developing a workforce that is resilient, competitive, and prepared for the future," Magill added.

The Department for the Economy's Skills Strategy has committed to increasing the proportion of the workforce with high-level skills from 34% to 44% by 2030, requiring substantial public and private investment in education and training programmes.

According to Invest Northern Ireland, businesses that invest in workforce development are 2.5 times more likely to report higher productivity and 4.4 times more likely to retain key talent.

As Northern Ireland confronts these workforce challenges, coordinated efforts between government, education providers and employers will be crucial to mitigate the projected skills shortages and maintain economic growth over the next decade.

Investment in Skills

Businesses across the UK and Northern Ireland are facing talent shortages, cost pressures and market uncertainties. In this situation, outsourced staffing offers a compelling alternative to traditional employment models. When implemented thoughtfully with suitable partners, this approach can transform operational challenges into competitive advantages.

Businesses in high-cost regions like London, Manchester or Belfast can achieve substantial savings through outsourced staffing arrangements. Depending on the function and location, cost reductions typically range between 30% - 60% compared to local hiring. Importantly, these savings need not come at the expense of quality when working with reputable providers.

For small and medium enterprises in Northern Ireland, where margins are often tight and competition fierce, these cost efficiencies can mean the difference between growth and stagnation.

As the business landscape continues to evolve, organisations that embrace flexible staffing models while maintaining their core identity and values will be best positioned to thrive in increasingly complex markets. Outsourced staffing, when viewed as a strategic partnership rather than merely a cost-cutting exercise, represents not just a temporary solution but a sustainable approach to business growth and resilience.